Avocados in Charts: Chile's exports in an ever-changing dynamic market

In this 'In Charts' series of mini-articles, Colin Fain of data visualization tool Agronometrics illustrates how the U.S. market is evolving. In each series, he will look at a different fruit commodity, focusing on a different origin or topic in each installment to see what factors are driving change.

To celebrate Chile's Independence Day on Sept. 18, I thought I would jot down a few words about their upcoming avocado season. With a good amount of fruit on the water, it will be interesting to see how many Chileans this article will be able to pry away from their barbecues.

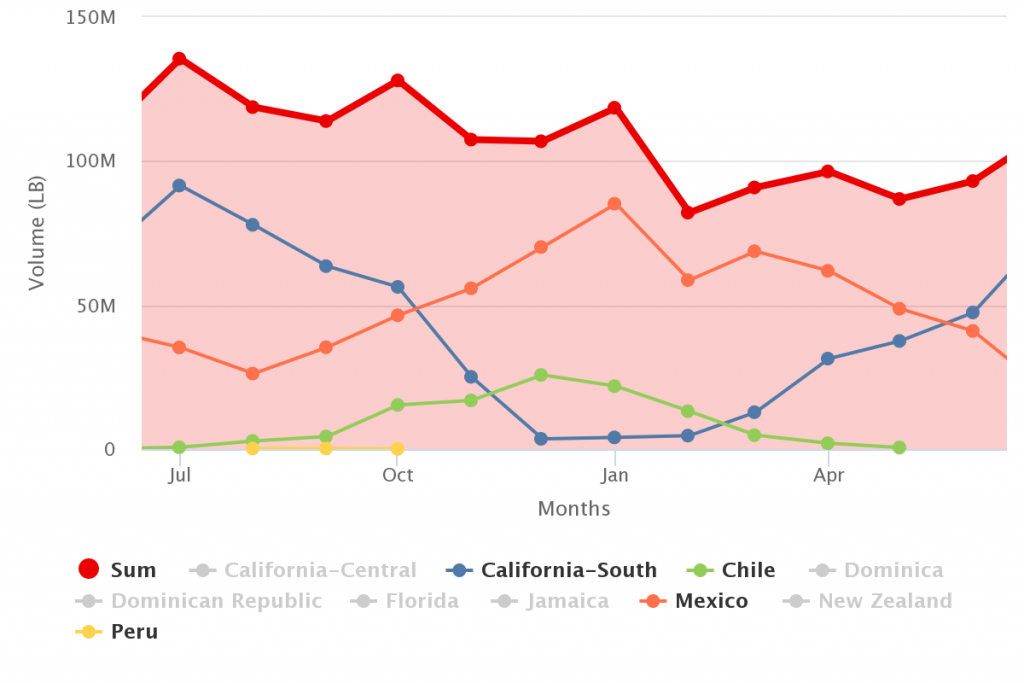

Lined up right after the U.S. and Peruvian seasons and roughly coinciding with the beginning of Mexico's, Chile has been shifting its commercial strategy over the last few years to target the point of the year with the least amount of fruit - that sweet spot right around September, October and November. In 2017-2018, exports to the U.S. represented 13% of the country's total production, according to industry body the Hass Avocado Committee.

US Avocado Movements by Origin 2017-2018

(Source: USDA Market News via Agronometrics)

But this wasn’t always the case. Stepping back in time we can see that Chile had a much more prominent role in the U.S., where it used to send upwards of 80% of exports. Chile's season naturally runs about a month or so before Mexico, meaning that much of their volumes overlap. Chile has found it harder to compete directly with the U.S.’s southern neighbor's limited shipping costs and time to market, which is what has been driving the change in strategy.

Given the massive distance that Chilean fruit has to travel, growers long ago focused on cultivating high-quality fruit that can survive the voyage, giving them a competitive advantage in other markets. The country has reduced its risks by diversifying and sending more and more fruit to Europe, their regional neighbors, the Middle East and China.

That said, the U.S. is still an important market and the world's largest consumer of the fruit. Chile's well-established producers are in a position where they can choose where to ship to, allowing them to shift volume to the U.S. or other markets depending on where they have better returns.

US Avocado Movements by Origin 2010-2011

(Source: USDA Market News via Agronometrics)

With the high prices that the U.S. has seen during August and September over the last couple of years, the market is an attractive but risky option for Chilean exporters. With travel times that range from three to six weeks - and another two weeks after arrival before the fruit is commercialized - the massive fluctuations in the market could mean fruit that was shipped out while prices were high could arrive once the market has bottomed out again.

As the Chilean season comes on board it will be interesting to see how they distribute their crop, which, even though it was reported to have suffered from some frosts in July, is expected to total around 245,000 metric tons - a 12% year-on-year increase on last year, according to the Committee.

Avocado Historic Monthly Shipping Point Prices

(Source: USDA Market News via Agronometrics)

In our 'In Charts' series, we work to tell some of the stories that are moving the industry. Feel free to take a look at the other articles by clicking here.

Agronometrics is a data visualization tool built to help the industry make sense of the huge amounts of data that you depend on. We strive to help farmers, shippers, buyers, sellers, movers and shakers get an objective point of view on the markets to help them make informed strategic decisions. If you found the information and the charts from this article useful, feel free to visit us at www.agronometrics.com where you can easily recreate these same graphs, or explore the other 20 fruits we currently track, creating your own reports automatically updated with the latest data daily.

To welcome avocado professionals to the service we want to offer a 5% discount off your first month or year with the following coupon code: AVOCADOS

The code will only be good till the 24th of September, so visit us today.