U.S. reversal on in-restaurant dining opening a "devastating hit" to foodservice produce sales

Fresh produce sales at U.S. retail in the second week of July were higher than the previous non-holiday week, but a Produce Marketing Representative (PMA) says that the reversal on the opening of in-restaurant dining amid Covid-19 case spikes is a "devastating hit" to foodservice produce sales.

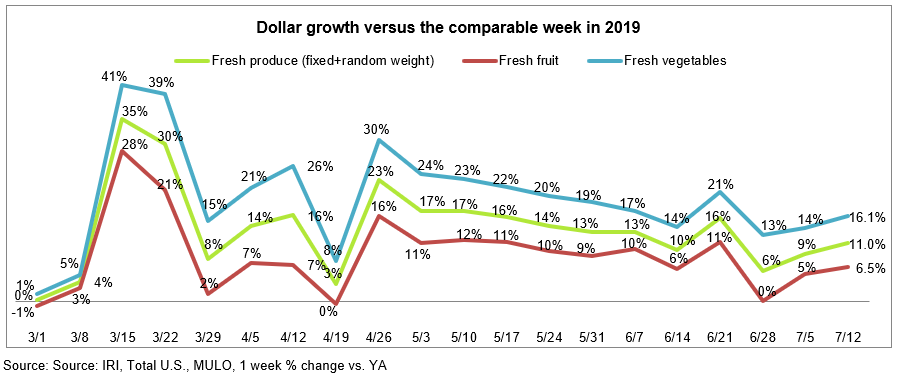

Elevated everyday demand drove sales gains of 11.0% over year ago for fresh produce during the week ending July 12 — the highest in several weeks.

Frozen and shelf-stable fruits and vegetables had higher percentage gains but off a smaller base, with particular strength for frozen, at +22.3%.

The fresh produce sales figures are slightly higher than the last non-holiday week in late June, which is notable as gains during non-holiday weeks had been experiencing some erosion in what seemed to be a slow march back to normal — only interrupted by big spikes during holiday weeks.

But the picture for the produce industry is not all rosy, as the mounting number of Covid-19 cases around the country prompts many states to revert to stricter social distancing measures

In some cases, this includes closing in-restaurant dining altogether once more. In others, dine-in capacity restrictions have been sharpened.

"We knew Independence Day was a tough bar to beat, so it was hard to say where everyday demand would land us in the non-holiday week,” said Joe Watson, VP of Membership and Engagement for the Produce Marketing Association (PMA). "I am pleased to see that everyday demand for fresh produce is strong, boosting sales gains back into double digits over year ago."

"But while the strong retail demand is a big plus for our industry, the reversal on opening in-restaurant dining is a devastating hit to foodservice produce sales. I am hopeful that the resilience and creativity of our industry during the early months of the pandemic will help optimize foodservice demand once more."

Fresh produce sales

Fresh produce generated US$1.39bn in sales the week ending July 12 — an additional US$138m in fresh produce sales.

Vegetables, up 16.1% from the prior year, had a 9.6 percentage point lead over fruit. Father’s Day excepted, fruit had its strongest week since mid-June, at +6.5% over last year.

"The continued strength of vegetables is very telling," said Jonna Parker, Team Lead, Fresh for IRI. “Fresh vegetables are supporting the continued at-home meal occasions that moved over from foodservice, particularly lunch and dinner.

"But at the same time, it is great to see that fruit had a strong week, and importantly, all sales measures were strong: dollars, volume and units. Unit purchases in fresh produce increased by 10.9% over the second week of July versus last year, while volume increased 9.5%.

"This to points to more, but smaller, packages sold during the non-holiday week as well. This affects pre-packaged produce and the types of promotions that will be effective in the current environment."

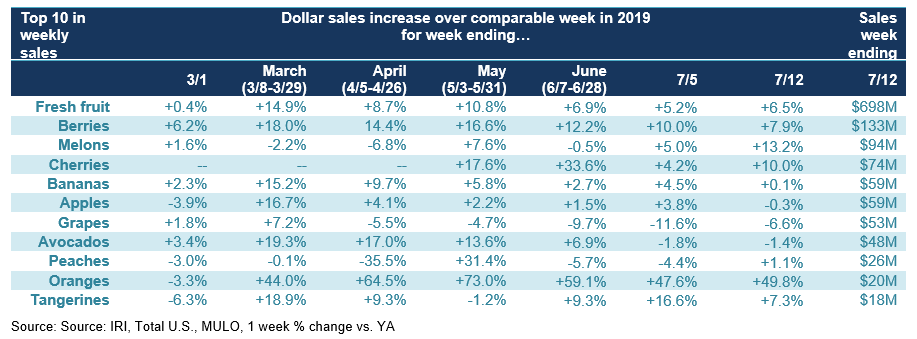

For fresh summer fruit, the week brought strong sales, she explained.

“Berries, melons and cherries make up the top three in total dollar sales," she said. "This is a great sign for the weeks to come. In other areas, such as peaches and avocados, consumer demand is certainly there but in a highly deflationary market, dollar sales trail volume sales by a wide margin."

During the week of July 12, double-digit gains were reserved for melons, cherries and oranges, with the highest percentage growth yet again going to oranges, at +49.8%.

Apples, grapes and avocados lost a little ground versus the same week in 2019, but all are affected by deflationary conditions and had volume increases even if dollars were down

In contrast to fruit, all top 10 vegetables increased in dollar sales versus year ago and many did so with double-digit gains.

Lettuce, which includes fresh cut salads, were the top sales category, followed by tomatoes and potatoes. The highest weekly gain percentage goes to corn, at +44.2%. Much of this increase was fueled by price increases, with volume up 17.9%.