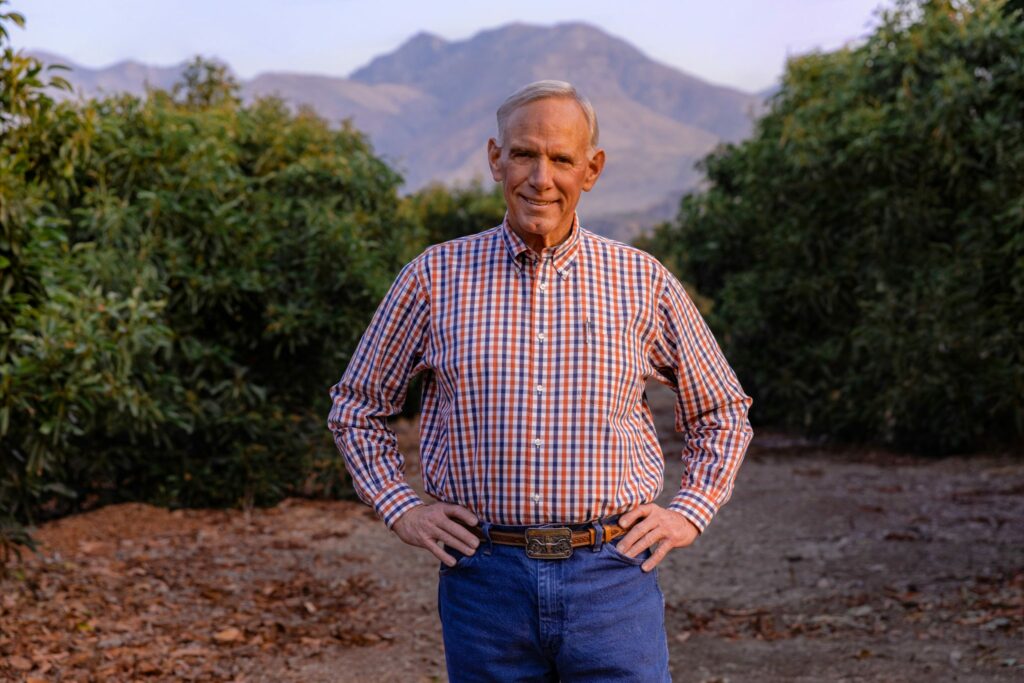

Steve Barnard, Founder and CEO of Mission Produce: We now import more to Chile than we export

From the July edition of Vision Fruticola magazine

The evolution of the global avocado industry over the last few decades has been nothing short of spectacular. Riding and driving that growth has been Mission Produce, a company based in Oxnard, California, that was founded in the early 1980s by Steve Barnard. The son of a citrus farmer in Ventura County, Barnard took numerous summer jobs at produce companies while studying ag business at Cal Poly, working his way up in the sector before eventually acquiring an avocado packhouse.

He has since transformed it into one of the world’s biggest and most recognizable avocado companies that has been a pioneering force, launching a variety of new products and ventures that have recently included the start of operations in South Africa, its entrance into the mango industry, and in September 2020 its listing on the NASDAQ Stock Market.

After you established Mission Produce around four decades ago, what factors helped you to bring it to where it is today?

There were three big things that happened. The first was globalization - the opening of the Mexican border into the US in 1997 - which gave the consumers here Hass avocados year-round. Consumption started to go up because we had a better product. We got rid of the green skins, which are not as desirable to eat and don't have the shelf life when shipped. You can't go around the world with them. The green skins were phased out here in the U.S., and happen in Europe too as time goes on.

The second thing – and we led the charge on this – was ripe avocados. We were the first and only. People back then were pre-conditioning, which is like going on a first date but not the second: you’re stopping before you should. And that is really what catapulted us to the front of the category here in the U.S. Now we are trying to do it in Europe, China, Japan, Korea and everywhere else by providing ripe year-round Hass avocados– that is the trick.

The third aspect is the health benefits. Avocados had a bad reputation back in the 1970s, because people thought they had cholesterol and wouldn’t eat them. But by doing the research, the industry found that they don't have any cholesterol in them, they actually have monounsaturated fat, which is good for your heart, and they’ve got fiber and potassium. So it changed the whole perception of the avocado. The avocado went from being bad to good and we just happened to be on the train at the same time.

Back in the 1980s, did you know that the avocado business would be so much bigger in the future?

Well, I didn't know it'd be what it is today. I just thought there is a company, which is still around today, Calavo, who had 80% market share. To get 25% would have been good – well, we have surpassed them now in size and market share.

You worked your way up the industry from the bottom. What gave you the faith to keep going and create what you have built today?

If you don't believe in yourself, no one else is going to. I've never been short of confidence. Sometimes I'm overconfident and get humbled.

Also, by starting at the bottom like we did, we were doing everything, loading trucks, working in the field, in sales - we were doing it all. We just saw an opportunity and we took it, and we are still taking it and creating that opportunity with new horizons such as Asia and Eastern Europe. There are a lot of opportunities out there, you just have to have the wherewithal and be in a position to do it.

And you can't be afraid to lose, or you're not going to do anything. When we lost in the mango business in the 1990s, we regrouped, and we came back looking a little different, changed our strategy, and we are back in that business. It’ll be a winner.

What happened in the mango business back then?

In the 90s we had mango operations in Brazil, Peru and Mexico. It started in Mexico because we had a team there for avocados so we thought we would spread out by packing mangoes. This went on for about three or four years and we got it up to some pretty good numbers. But we were having to buy the crop on the tree every day at a price, so it was hard to predict to go to a retailer and give them an ad price. So we thought we would be smart and buy the whole crop on the tree right after the bloom.

Well, what I hadn't calculated was a hurricane. It came in and parked itself over that region for about two weeks and we couldn’t get to the orchard. By the time we got to it, the crop looked alright but it was weak, and by the time we got it out of there it was destroyed.

The accountant came in and dropped that paper on my desk and he said: “We’ve got problems. You lost 2 million dollars in six weeks.” So right there we were out of the mango business. It was a memory that we didn't talk about for several years.

Well, we are back in it now growing our own, so we are going to see if we can make it work with a different strategy.

And speaking about another major recent milestone for the company – last year you listed on the NASDAQ. There aren’t many fresh produce companies that list, how did you know that this was the right step for Mission Produce?

I didn't. There are a few of them out there and the ones that I talked to said: “Don't do it.” But you know what? It's been okay. I have to behave a little more, which is new to me, but you get a rhythm to it. The process was pretty brutal getting there, when you're doing ten one-hour presentations a day for two or three weeks in a row, your eyeballs start to cross. We have to do things differently, but we are getting the groove to it and it seems to be working, and I never thought I would say that.

As a publicly listed company are you now in a much stronger position to take advantage of new opportunities?

We can move faster. Our goal has always been to extend our footprint and now we have more horsepower to speed up. It also provides our long-time shareholders from 37 years ago some liquidity.

What are some of the biggest changes you expect to see in the global avocado industry over the next 10 or 15 years?

Well, I think the Hass variety will continue to dominate. I think you'll see a reduction of green skins offered in the marketplace. There are some areas that grow a fair amount of green skins like South Africa and Israel, and I think that will continue to change – by either grafting them over or replanting them – and they’ll have more of a Hass type variety. There are some variations of Hass - some come early, and some come later and whatnot - but it will be a Hass-type, Hass-looking, Hass flavor, good ship-ability where you can go around the world with it, but green skins are pretty limited. Those have thin skin, and a watery flavor rather than a rich oil flavor, where I think there will be a continued transition.

Looking at per capita consumption, when we started business here in the U.S., it was about two pounds, including the green skins which represented maybe 60 percent of the business back then. Now we have a Hass type variety, ripen them and have them year-long. The consumption in the U.S. is now 8.5 pounds, and I think that we can continue heading in that direction in Europe and Asia. Both regions are at about two pounds per capita right now, but growing.

And China is coming on fast, but we have an industry tendency to overload those things. It needs to be more of a program that has a consistency and rhythm to it. You can't send 100 loads there in a week or you're going to choke it. You have to increase it gradually, so it will pull it through rather than push it through.

Do you think rising global demand will continue to be roughly in harmony with the significant production increases in the future?

Well agriculture has a tendency to see a good thing and then over-plan it. The answer to your question is yes, they will, but it won't be on a year-long basis. There will be specific months where there will be too much.

We are being pretty strategic. We've got a development going on in South Africa now and we continue to develop in Peru, Guatemala and Colombia. We know where those are going to go and what time of the month they’ll go there, so we're working it backward from the marketplace. Will every day be perfect? No, but we have a pretty good idea of where it's going to go and when. I can't say that all growers around the world have that plan.

Peru has seen amazing growth in avocado production over the last few years. Do you see it continuing to expand at a similar rate?

No. To give you an example, the difference between Peru and California – because they come off at the same time of the year – is that California is limited because of water, urbanization, land costs, labor and everything else. In terms of available land in the avocado world, know there is zero, and you can only grow these things in Southern California along the coast - that's the only place in the whole United States where you can grow these things because of the climate. They don't like it too hot, cold, windy, sunny, or dark.

Peru has more land than they can plant. But Peru’s season is condensed because it is warmer day and night. We can hold the crop in California on the trees for up to six months between start and finish at the harvest, and in Peru, you've got three months. It's just a condensed season so you have to be careful that you don't overload yourself.

A lot of these guys plan a couple of hundred hectares of avocados, and they plan it without really knowing what they're going to do with it. Where in our case, we work it backward, we started out in the distribution business first and now we're in production to fill the need for distribution rather than starting out with the supply business and figuring out where we’re going to go with it. So we pull it through the system, where others push it with price.

What place does the production chain have in the avocado business?

Let's start with the cold chain. We cool the fruit in many cases before it leaves the field to get that field heat out of it instantly. That adds weeks to the shelf life. You have to keep it cold - don't cool it down and then put it out in the sun. But a lot of these guys pick it, haul it to the packing house and pack it the next day and then cool it after that. Well you lost 36 to 48 hours when that fruit is ripening, so it really limits where they can go with a quality product.

I've seen it happen in three days in Peru, and these are pretty big companies. They get to the market and it's starting to ripen and they have to discount it. Look at it from the buyers’ and the consumers' point of view, what do they want? Well, they want flexibility, and they want a product that isn't going to go over the hill in 48 hours.

What are your thoughts on the role Colombia will play? Could it eventually rival Peru in terms of volume?

I don't think it'll get anywhere close to Peru. Peru has massive land holdings there with water. In Colombia the terrain is pretty tough, getting roads in and out it is pretty mountainous and it is going to be limited. Yes, they are planting a fair amount, but a lot of it isn't irrigated because it rains a lot. It doesn't rain every week, so the tendency is to have smaller sizes.

It will be viable, there will be a good little niche to fill in gaps in the supply chain. Is it going to overtake Mexico? Not unless there's a situation in Mexico of some nature that shuts down supply.

What is your outlook for Chile over the next 15 years or so?

Well we export a fair amount out of Chile at certain times during the year, but we import more now to Chile than we export. They are becoming a big consumer per capita consumption. I don't know the number, but I'm going to guess it is around 12 pounds, it is a big number. So there is an opportunity there.

The window to export out of there is very narrow. It's about two or three months and they are consuming so much more there that there is still an opportunity, it’s just different. We are sending products straight from Peru to Chile. We have sent them from California and Mexico as well. Who would have ever thought we would be shipping products from California all the way to Chile? But we've done it.

Do you see production in Chile increasing in the future, or do you expect it to be more stable?

I think that it will be stable, if they are lucky regarding the drought. It is hard to predict the future on weather. Production is their biggest limitation I think going forward, unless something changes weather-wise.

Water has become a big topic with avocados, and the industry has got somewhat of a bad reputation in that regard. How do you address this issue?

Well, I don't know where we rate on the size of the farm in the world, but we are probably one of the top five largest avocado farmers between California and Peru and what we are going to be doing in South Africa. Everything we do is automated, and we use Israeli systems that monitor the root zone and the water usage, and it shuts itself off. We have probes in the trunks of the trees, so it tells us when it's thirsty and when it's not thirsty, and it turns itself on and off and it doesn't leach the nutrients.

With our precision farming techniques, we reduce 40 percent of water per avocado, and that comes up and these analysts call all the time about water usage. First of all, you have to have water to do anything. We monitor it and don't waste it because it is a finite resource, number one, and you're leaching fertilizer, number two, so it is in our best interest to not overuse water and to make sure that the tree is only getting what it needs and does get what it needs. So we spend the extra money upfront.

Do you think the need for the economy of scale and investment in this kind of precision technology will lead to increased consolidation in the industry?

Yeah, I think so. I think there will be consolidation or elimination - just take the avocados out and do something else. The key is getting production, if you don't have production, it’s a challenge.

You’ve always been a progressive grower. Do you think that that contributes to success?

Oh sure, playing offense. Trying something new. Because if we have an issue there or I don't like the results, or I don't like the way that tree looks, or I think that there's something wrong with that block, we do something different.

In a few words, what is your outlook for Mission Produce and the avocado industry?

I think we are in a good category. We're in a good position within the category and we're going to continue to play offense. There are still a lot of uncharted waters out there.