The Hass Horn: 2017 Avocado Outlook

By avocado industry veteran Avi Crane

The United States Department of Agriculture (USDA) will not publish the final composite 2016 assessment figures (therefore, the official USA avocado consumption) for several weeks. The unauthorized harvest cessation that occurred in Mexico this fall resulted in the first year-to-year decline of the sales of Mexican avocados in the USA since full market access was granted by the USDA on Feb. 1, 2007.

The United States Department of Agriculture (USDA) will not publish the final composite 2016 assessment figures (therefore, the official USA avocado consumption) for several weeks. The unauthorized harvest cessation that occurred in Mexico this fall resulted in the first year-to-year decline of the sales of Mexican avocados in the USA since full market access was granted by the USDA on Feb. 1, 2007.

Despite an increase of USA Hass production (+39.3%) and the increase of imports from Chile (+165.1%) and the Dominican Republic (+43.2%), total USA avocado consumption increased by only 3.5% in 2016 vs. the prior year (avocado imports from Peru dropped 32.3% from the prior period).

In 2016, avocado supply from Mexico proved unpredictable resulting in a year-to-year consumption increase of just 76.5 million pounds vs. the previous 5-year annual average of more than 200 million pounds.

As noted in a previous report, during the “strike” the retailer and food service sectors in both Canada and the USA suffered considerable financial and customer relations damage. Now these companies and their suppliers in the USA are seriously considering alternative avocado sources, such as Colombia, Spain and South Africa.

During the period of limited product from Mexico, avocado exporters from Chile diverted fruit to the USA and obtained excellent returns and the avocado producers in other countries have taken notice.

2017 Outlook

In 2017, the avocado industry can easily see a 200-million-pound (or more) increase over this year. The weekly demand is 50 million pounds in the USA (and more than 10 million in Canada).

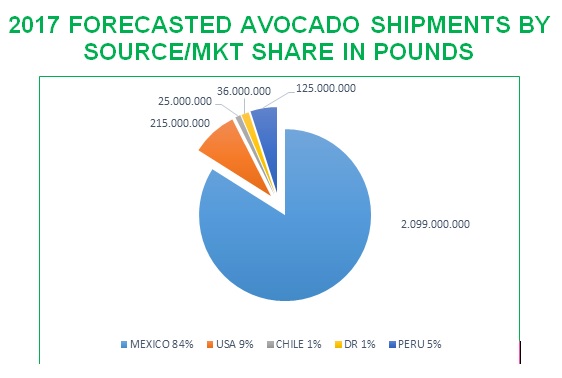

However, as mentioned in an earlier post, the huge “victory” in the fall event will encourage similar actions in the future. My forecasts below, however, assumes no interruption of shipments of Mexican avocados to North America during the coming year. My analysis forecasts total 2017 avocado consumption in the USA at 2.5 billion pounds as follows:

USA

Due to the unprecedented May heatwave in California, the damage to the 2017 USA avocado crop was severe. My analysis forecasts a 41% decrease in USA Hass production. At 215 million pounds, the volume is not enough to supply the market in California. With the “Buy Local Produce” campaigns by the State of California, retailers and fast food chains in the state will be under pressure, as in the past, to source their May to August period avocado needs only from the 12 companies with packing operations in California. FOB (freight on board) prices for USA Hass producers could receive a premium of up to US$15 per cartons vs. the same product from Mexico sold in Arizona, Nevada and Oregon. These high FOB prices, however, will not be high enough to compensate the producer for the cost of production.

Chile

This past year was an anomaly regarding the import of avocados from Chile. The main destination market for Chilean avocado production remains the domestic market, Argentina, Europe and Asia. A 54.5% decrease in volume from Chile for the USA is forecasted for 2017.

Dominican Republic

Hass avocado production is expanding in the Dominican Republic. Proximity to market and low production will continue to provide an advantage to the avocado producers in the DR who ship to the USA (Florida). 2017 is forecasted to see a rise of 35% in imports of avocados from the Dominican Republic vs. the prior period, 36 million pounds (2017) vs. 26.5 (2016) million pounds.

Peru

With new hectares coming into production, Peru has the capacity to increase it shipments in 2017 by 73.8% over the prior period. This level of increase can be achieved without shorting its traditional markets in Europe and the U.K. Even at 125 million pounds, this level would be lower than in 2014.

Mexico

With increasing production in the states of Michoacán and Jalisco, Avocados from Mexico has the capacity in 2017 to increase the volume exported to the USA by 20.8% over the prior period.

Avi Crane is a former executive of Calavo Growers, Inc. (CVGW). Crane served as Vice-President at the California Avocado Commission, established and managed the Chiquita Avocado Program and began his career in the avocado industry as a Producer. Currently, Avi Crane, along with his partner in Mexico, is working directly with producers to secure lines of credit to cash flow their production costs and to facilitate their shipments to the USA.

He can be reached by email at avicado@worldavocados.com.