Chilean table grape export surge sends prices plummeting in the U.S.

Chilean table grape shipments to the U.S. in February were almost the same as the first five months of the 2015-16 season.

From September last year through this January, Chilean table grape exports were up 41% year-on-year at 125,766 metric tons (MT), and the trend has shown no signs of letting up since then.

It is worth noting that in previous seasons the September-January period has represented about 9-14% of volume, so it is now that the real volume impacts will be felt more acutely.

According to statistics from Chile's Office of Agricultural Research and Policy (ODEPA), from Feb. 1-23 total table grape exports hit 95,655MT, of which 61% went to the U.S., followed by South Korea with a much smaller volume of 7,056MT.

China was the third-largest receiver last month importing 6,692MT, followed by the Netherlands (5,404MT), Canada (2,887MT), the U.K. (2,861MT) and Mexico (2,027MT).

All these leading markets except Canada witnessed huged upticks in imports of Chilean table grapes between September and January as well, with the Netherlands recording the highest rise in percentage terms at 1638%, followed by the U.K. (+452%), China (+229%), South Korea (+100%), the U.S. (+89%) and Mexico (+47%).

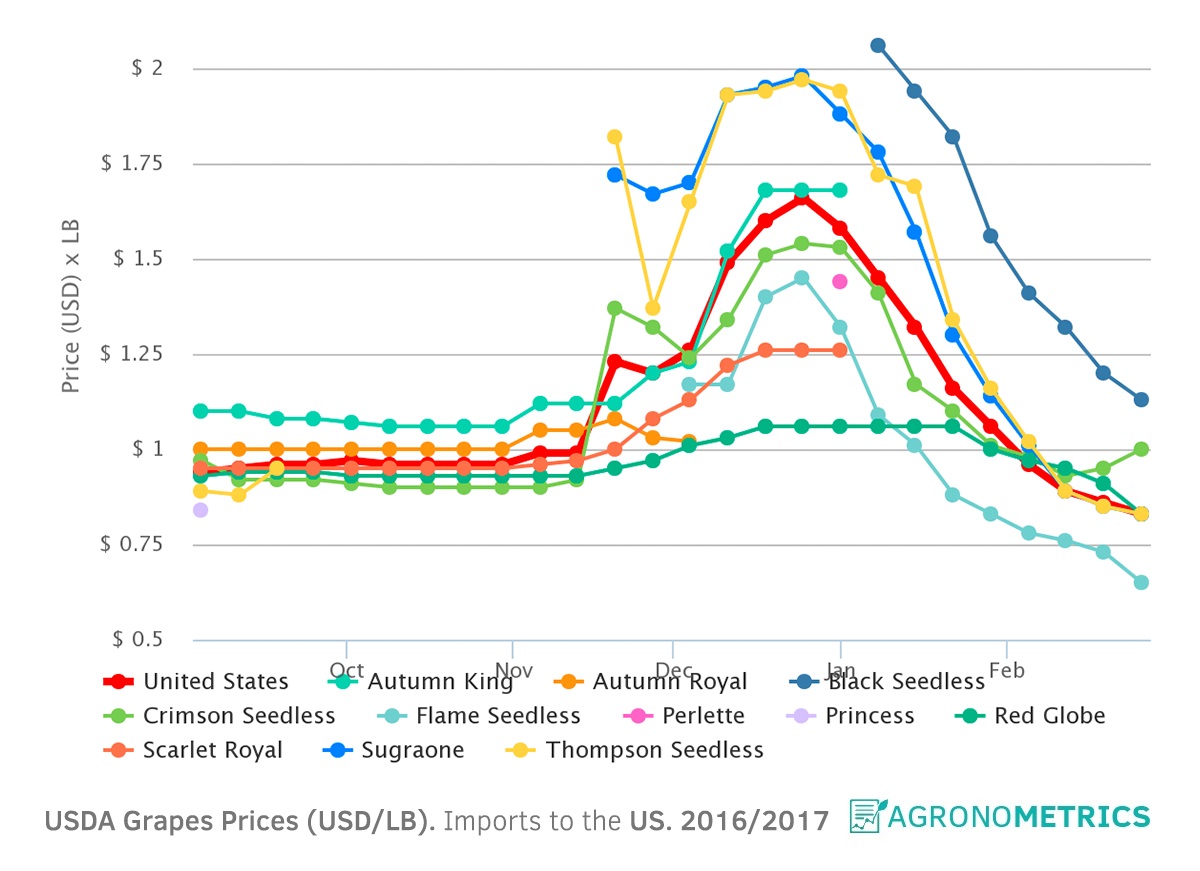

The impact on price in the U.S. is clear, as illustrated by the following graphs prepared by Chile-based Agronometrics: