U.S.: Fresh produce sales fall from peak but remain high at end of March

Fresh produce sales the last week of the month in the U.S. saw a decline from their mid-March spike, but they still remained much higher than the same week last year.

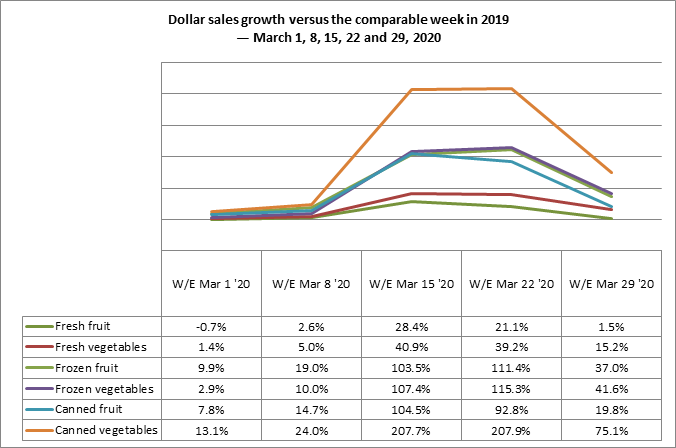

A similar trend was also observed in sales of both frozen and canned produce sales, although both those categories were far outpacing fresh, according to a report by 210 Analytics in collaboration with IRI and the Produce Marketing Association (PMA).

During the week ending March 29, produce sales continued to show highly elevated levels regardless of where they were sold in the store, despite many chains running limited opening hours.

Fresh produce sales increased by 8.1% year-on-year, while frozen produce sales were up 41.6% and shelf-stable produce sales rose by 51%.

“We see fundamentally different consumer engagement with produce amid COVID19 and week three continued to show a three-way split of the produce dollar between fresh, frozen and shelf-stable,” said Joe Watson, VP of Membership and Engagement for the Produce Marketing Association (PMA).

“This is why fresh produce never saw the kind of surge in sales that we’ve seen in fresh meat or other perimeter departments. At this point, many shoppers are looking to minimize trips.

"It’s important to encourage fresh produce consumption by providing tips about items for now and items with longer shelf-life to have ample fresh fruit and vegetables for the entire week.”

Fresh produce

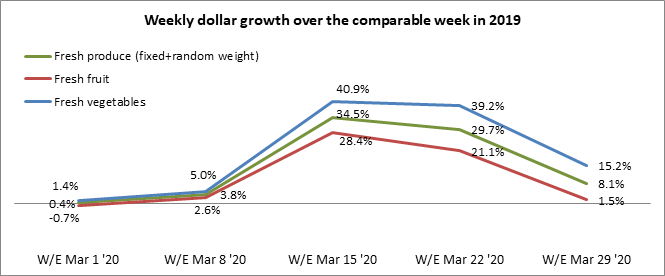

The March dollar growth trend line for fresh fruit shows very strong results for the week endings March 15 and March 22 and a return to more moderate growth levels the week of March 29, at +1.5%, which translated into an additional US$9 million in sales.

Sales growth patterns for fresh vegetables were similar, but higher. For the week ending March 29, IRI showed vegetables up 15.2% —adding US$88 million versus the comparable week in 2019.

It is important to point out that stockouts and purchase limits may have affected reported gains. Additionally, distributors are finding creative ways of going consumer-direct. These sales are not reflected in these numbers.

Source: IRI, Total US, MULO, week ending March 1, 8, 15, 22 and 29, 2020

The all-important question is how much of a role price played in all this, with the heavily reduced foodservice demand providing ample produce supply.

At the onset of coronavirus in the U.S., dollar and volume sales were relatively close together for total produce, at +0.4% for dollars and +1.3% in volume. However, particularly the week ending March 22, volume sales far exceeded dollar sales, creating nine point gap, which would indicate deflation setting in at retail for some areas.

Source: IRI, Total US, MULO, week ending March 1, 8, 15, 22 and 29, 2020

The gap was widest for vegetables, particularly the latest two weeks. For the week ending March 29, volume sales gains for vegetables were more than 10 points higher than dollar growth.

Top fresh items in dollar growth

For the third week in a row, potatoes were the growth leader in absolute dollars, selling US$32 million more than in the comparable week in 2019, or +65.1%.

Others that gained big in dollars were onions, tomatoes and oranges. But at the category level, big differences between dollars and volume were observed for some fruits and vegetables as well.

“We’re seeing significant disparity in dollars and volume sales growth for many fruits and vegetables,” said Jonna Parker, Team Lead, Fresh for IRI.

“Looking at the 10 fruits and vegetables that added the most new dollars in the week of March 29, for instance, shows significantly higher volume than dollar growth for items such as onions, carrots and lemons. This is likely the direct influence of the decline in foodservice demand.”

Parker also points out that produce categories with longer shelf-life, cook well or are easy to snack on having grown demand over the past few weeks.

“The produce industry is a resilient business,” said Watson, "but farmers and producers of fresh fruits and vegetables need our support now more than ever as many restaurants are doing a fraction of their normal volume and this is having downward pressure on prices.

“The produce industry is a resilient business,” said Watson, "but farmers and producers of fresh fruits and vegetables need our support now more than ever as many restaurants are doing a fraction of their normal volume and this is having downward pressure on prices.

"We are actively working to connect supply with shift in demand from foodservice to food retailing and fresh to frozen and canned. Additionally, it is important to reassure Americans that fresh produce is safe and emphasize the very important role of produce in the diet.”

In fresh fruit specifically, the 1.5% year-on-year rise in fresh fruit sales in the week ending March 29 was driven largely by oranges, lemons and avocados.

Oranges saw the biggest gain in absolute dollars, up US$9.8 million over the week of March 29 over the comparable week in 2019, or +42.7%. Meanwhile, avocados were up US$7.5 million or 17.8%, and lemons were up US$4.4 million or 32.7%.

Berries, apples and bananas remain the largest categories and all saw single-digit sales growth. Grapes, melons and pineapples all saw double-digit year-on-year sales declines.

Fresh produce share decreases

Consumers continued to split their produce dollar three ways during the week of March 29. Frozen and canned vegetables had ongoing strong growth during the last week of March.

Source: IRI, Total US, MULO, week ending March 1, 8, 15, 22 and 29, 2020

“With the stocking up on canned and frozen produce slowing down this week, the share of dollars going to fresh dollars was significantly higher than we’ve seen in recent weeks,” said Parker.

“However, at 76%, the fresh produce share is still significantly lower than its typical share, with continued above-average strength for frozen fruits and vegetables.”