U.S. retail fruit sales reported increases across the board in November, grapes saw double-digit growth

All top 10 fresh fruit items gained versus a year ago, according to a report done by IRI, 210 Analytics and the Produce Marketing Association (PMA).

Combined with record-setting inflation and substantial supply chain constraints, the market has yet to find a new and consistent level of balance.

Year-to-date, prices for total fresh produce are about 6% higher than they were last year. Inflation for fruit is above average, at over eight percent year-to-date through November 28.

Fruit prices during November 2021 were 12 percent higher than in November 2020.

Jonna Parker noted that shoppers are very aware of the widespread inflation: 90% of primary shoppers reported grocery item prices being a little (42%) or much (48%) higher.

Among consumers who noted higher prices, 92% are extremely (41%) or somewhat concerned (51%).

“This translates into 83% of primary shoppers being aware and concerned of the inflationary conditions,” Parker said.

Fruit sales growth slowed a little to +8.5% versus November 2020, but gains remained more than 18% ahead of the pre-pandemic 2019 levels.

Fresh Fruit Sales in November

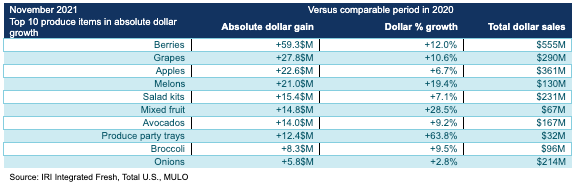

All top 10 items gained versus a year ago with berries being by far the biggest fruit, still growing nearly nine percent year-on-year.

Grapes, melons and mixed fruit reached double-digit gains in November.

Grapes had mostly a flat year in 2020 but sales have been accelerating since the third quarter of 2021.

Citrus fruits have a big representation between mandarins and oranges. Lemons fell just outside of the top 10 with $62 million and a gain of three percent versus 2020.

“The top 10 in absolute dollar gains showed both small and large categories are important for department growth,” said Parker.

“It is always interesting to keep an eye on some of the smaller sellers that manage to gain in a big way. This month, that included mixed fruit and party trays — a clear sign that people were entertaining this month.”