"Buyers should plan ahead": C.H. Robinson provides global freight market overview

Third party logistics provider C.H. Robinson has provided a global freight market overview and some recommendations to the industry for how to best manage the disruption.

“As COVID-19 surges in multiple countries, factories may be forced to shut down and airport and ports may impose restrictions that handicap operations,” said Airfreight Director, Vincent Wong.

Strict measures were implemented to control Omicron’s spread. In China and Hong Kong, stringent quarantine requirements will have an impact to supply chain operations and further reduce flight capacities. Buyers in the U.S. should plan ahead to mitigate interruptions to their supply chains.

Following a brief decline in early January, air freight rates are expected to increase into the Lunar New Year (LNY). Capacity will continue to remain tight, especially as standard, routine cargo is planned, and prioritized, in advance of upcoming holidays.

Flight cancellations with carriers like Cathay Pacific have already pushed Hong Kong rates up by 10-15% in the first week of January.

In Asia, shippers will attempt to load ocean-bound cargo in advance of the LNY. Therefore, the month of January will show strong demand and increasing rate levels on the Transpacific and Asia-Europe trades.

COVID-19 outbreaks have amplified the existing challenges in the ocean market, as seen in Ningbo, China. Equipment movement is going to become more difficult locally as travel restrictions shape truck movements.

Port congestion in the United States continues to strand vessels and limit equipment availability. Los Angeles/Long Beach has more than 100 vessels offshore with average 20–30-day dwell, while Seattle and Tacoma are seeing an average of 15 days to berth. Congestion at Oakland also continues to increase.

The implementation of additional dwell fees at Los Angeles/Long Beach has been postponed nine times but will be reviewed January 17, 2022.

Southeast Asia transshipment ports are impacted, causing delays on non-direct services via Asia. Outport capacity is being constrained by limited feeder capacity. Carriers have suspended feeder space from Indonesia and Manila because of high charter costs for smaller feeder ships.

Ocean Freight Update

Overall capacity is affected by ongoing port congestion in many trade lanes. Vessels are frequently delayed back to origin, missing scheduled port calls to unload empty equipment and pick up new laden exports to the United States.

- Estimated since the second half of 2021, at least 10% of the global fleet is absorbed by the delays

- Some shipping lanes are seeing even greater impact, such as Asia to the U.S. West Coast, where capacity is reduced by 20-30% due to port congestion

Shipping lines are also constraining base port loads to Los Angeles/Long Beach to reduce the number of long dwell containers in the port in favor of inland Interior Point Intermodal (IPI) loads.

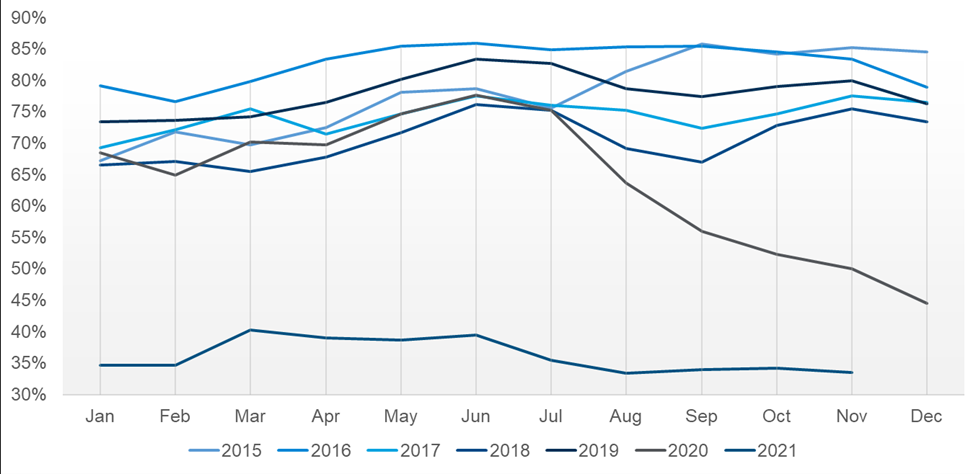

Global Schedule Reliability

Shipping schedule reliability plunges to historic lows

Schedule inconsistency and operational constraints are projected to continue. Additional considerations to remember:

- Forecast 6–8 weeks minimum

- Prioritization

- Variability in SKUs/parts

- Smooth volumes week-to-week

- Regular communication with C.H. Robinson

Europe

With an estimated 25% of the workforce absent because of COVID-19, sustained interruptions endure.

- Port congestion persists, especially in Rotterdam and Antwerp

- Inland traffic is snarled with inadequate number of drivers

South America

Trade lanes in and out of South America are actively seeking new bookings. However, the delays associated with moving cargo inland, by truck or rail, persist. Getting cargo to the coastal ports is the dominant factor in whether cargo will sail as originally booked.

- East coast continues to experience delays

- West coast is facing greater interruptions throughout Peru and Chile

Oceania

All markets to and from Oceania have limited space and equipment. It is advantageous to plan 4–6 weeks in advance. Vessels have been re-routed to other ports to minimize delays because of congestion in Melbourne.

Several carriers have suspended transshipment service from the West Coast of North America to Australia and New Zealand because of significant congestion and challenges with feeder connections from Asia to Oceania. New bookings from U.S. East Coast have also been discontinued by a few carriers until the backlog is cleared.

Asia to Oceania grapples with space—rates on the rise

Space is continuing to be a major concern, especially in Adelaide and Fremantle, Australia, where it is only available under space protection or a freight premium online procurement. Carriers may implement large GRIs mid-February after a prolonged rate freeze to level out their FAK rate with others in the market.

"Biggest factor to help reduce impacts to your supply chain—continue to book early," C.H. Robinson said.