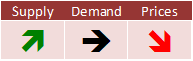

Decofrut presents the State of the Market for table grapes during December, looking at supply, demand and pricing for three markets - the U.S., Europe and China.

Over the course of February, there was an increase in arrivals and openings of table grapes in the Chinese markets in most varietal groups, while for Red Globe there was a constant supply.Almost all volumes came from Peru, but also saw the first batches and a growing supply from Chile, followed by few arrivals from Australia and South Africa.

With regard to sales, the white seedless registered movements which remained regular, leaning towards good depending on the availability offered in a few weeks.

For its part, the greater supply of black seedless grapes and red seedless grapes, as well as the greater breadth of varieties, pushed sales from fair to good at the end of the month. Finally, Red Globe registered a demand with a regular movement over the last month.

For supply, the majority of the volumes consisted of black seedless varieties, specifically Sweet Globe and Autumn Crisp, followed by lots of Red Globe. In the case of the red seedless grape, the dominant variety continued to be Ralli Seedless. For the black seedless grapes, the preference was Sable Seedless.

The first arrivals from Chile of the season, which showed up in week 6, were scarce batches of Ralli Seedless. On the other hand, new openings were registered in the season for white seedless grape varieties, such as Thompson Seedless and Arra 15; and red seedless grapes, such as Crimson Seedless and Arra 29; among other varieties with smaller volumes.

As for the last month (weeks 5 to 8), the prices of the majority group, white seedless, averaged US$4.71/kilo (-12 percent compared to last month), a figure 21 percent lower than the previous season. In red seedless, these were traded at US$2.90/kilo (-32 percent), registering a drop of 10 percent compared to the prices of the previous year.

Red seedless grapes were valued at US$4.17/kilo (-26 percent), a 6 percent lower price compared to last season. Finally, for black seedless,, the grapes were quoted at US$3.90/kilo (-29 percent), presenting values -13 percent in relation to the previous season.

During the month of February, the month started with continued low availability that was alleviated as the month progressed, together with the arrival of new Chilean and Peruvian shipments, significantly improving the supply of all variety groups especially red seedless varieties, a situation that put pressure on prices in February.

On the other hand, the rapid increase in availability and the lack of promotional campaigns by retailers made it difficult to move the fruit, especially towards the end of the month for red seedless varieties.

As for table grapes sold on the open market, volumes were 24 percent higher than the previous month, while the supply was only provided by the southern hemisphere.

Regarding prices for February, imported seedless whites averaged US$3.96/kilo, together with a monthly variation of -1 percent and an annual variation of +24 percent. For red seedless, the average was US$3.40/kilo, a value 15 percent lower than in January and 18 percent higher than in the same month of 2021.

For black seedless, the average value was US$3.62/kilo, decreasing by 7 percent month over month, and 9 percent above the previous year. For Red Globe the average price was US$3.09/kilo, a monthly difference of -1 percent and an annual difference of +23 percent.

As has been the trend in recent months, the supply of table grapes in Europe has been quite low in general, especially within the group of white seedless varieties (BSS). Stocks were made up in a greater proportion per grape from Peru and South Africa, while Chile, Namibia and India were also present, but in a smaller quantity.

In the case of Chile in particular, shipments to the continent were quite limited,with those arrivals mostly destined for Holland, Russia, England and Spain. During this period, the demand was in line and at adequate levels, according to the available supply.

In the particular case of the Red Globe (variety, interest tended to increase as the weeks went by. In the second fortnight of February, the market for seedless grapes was quite divided, with a lower availability of white seedless varieties and a greater amount of supply, in the case of red seedless grapes.

The pace of sales for the first varietal group was quite fluid, particularly for fruit of good quality and general condition; while, on the contrary, stocks of the second varietal group, being abundant and varied, ended up putting pressure on sales and prices.

Regarding the quality and condition of the grape, South African fruit continued to arrive with problems, mainly rot, in batches of seedless varieties; while that of Peru and Namibia were reported quite good, without major problems.

Finally, regarding prices, during week 09 of 2022 ,overseas white seedless and red seedless varieties in punnet format were offered at averages of €3/kilo and €2.50/kilo, respectively; while, in the case of the RG variety, prices averaged around €2.25/kilo (4.5-kilo box) and €2.15/kilo (8.2-kilo box) for the offer from Peru.