Agronometrics in Charts: What’s in store for Chilean cherries in the 2022-23 season?

In this installment of the ‘Agronometrics In Charts’ series, Sarah Ilyas studies the state of the Chilean cherry season. Each week the series looks at a different horticultural commodity, focusing on a specific origin or topic visualizing the market factors that are driving change.

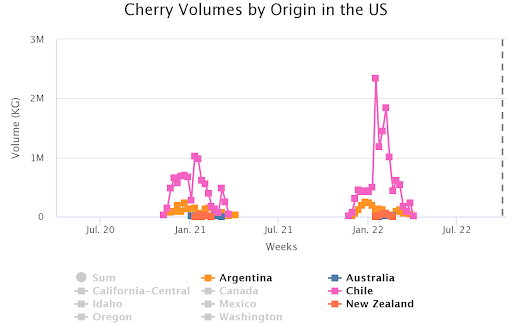

Chilean cherries account for over 95% of counter-seasonal supply of cherries from the Southern hemisphere, their primary destination being China. According to the USDA GAIN report published on August 15, 2022, producers of the fruit expect the upcoming season to be highly productive due to favorable climatic conditions during winter, with more rainfall in comparison to the previous season.

Due to the projected increase in area planted and yields, estimates for cherry production are at 465,000 MT, a 19.2% increase over the previous season. Industry sources project the area planted to continue growing at this pace until 2030. In the 2021/22 season, cherry exports to the United States grew by 91.9%, clearly demonstrating the industry’s strategy to diversify its export markets and reduce its dependence on the Chinese market.

The dominant cherry varieties produced in Chile are Lapins, Santina, and Regina. According to Smartcherry’s latest Phenological Report, currently cherries in Chile are mainly in a state of flowering to fruit set, depending on the variety and production place, although in the southernmost areas they have just begun budding. In the earliest producing area of the country, the Coquimbo region, however, harvests are expected to start around week 42.

Producers are constantly testing new varieties based on potential yields and projected prices. The national genetic improvement program (programa nacional de mejoramiento genético, PMG) for cherries, carried out by INIA with support from the Biofrutales consortium and the Chilean Economic Development Agency (CORFO) is paying special importance to scouting for cherry varieties that are competitive, visually attractive to the consumer, travel well, and can be cultivated in Chile’s center-north region, without the need for chilly winters, says Dr José Manuel Donoso, a geneticist on the INIA program.

Source: USDA Market News via Agronometrics.(Agronometrics users can view this chart with live updates here)

Source: USDA Market News via Agronometrics.(Agronometrics users can view this chart with live updates here)

Source: USDA Market News via Agronometrics. (Agronometrics users can view this chart with live updates here)

Source: USDA Market News via Agronometrics. (Agronometrics users can view this chart with live updates here)

Source: USDA Market News via Agronometrics. (Agronometrics users can view this chart with live updates here)

Source: USDA Market News via Agronometrics. (Agronometrics users can view this chart with live updates here)

According to the USDA GAIN report, domestic consumption for Chilean cherries is expected to increase by 2.7 percent owing to increase in production and higher availability of cherries. The 2021-22 season was characterized by significant increases in the costs of shipments due to inflated fuel prices and high demand for containers.

Processing fruit quickly and efficiently, preventing damage during transportation and maintaining fruit firmness are major concerns for cherry exporters. “80% of the production takes place during a tight 8-week period, when the workforce is insufficient and any additional logistical problem results in the cherries getting damaged. For this reason, the industry needs to expand its production window, diversify its varietal matrix and spread out its markets”, says Rodrigo Cruzat, manager of Biofrutales.

In our ‘In Charts’ series, we work to tell some of the stories that are moving the industry. Feel free to take a look at the other articles by clicking here.

All pricing for domestic US produce represents the spot market at Shipping Point (i.e. packing house/climate controlled warehouse, etc.). For imported fruit, the pricing data represents the spot market at Port of Entry.

You can keep track of the markets daily through Agronometrics, a data visualization tool built to help the industry make sense of the huge amounts of data that professionals need to access to make informed decisions. If you found the information and the charts from this article useful, feel free to visit us at www.agronometrics.com where you can easily access these same graphs, or explore the other 21 commodities we currently track.