Agronometrics in Charts: First prices for Chilean cherries on the U.S. market

In this installment of the ‘Agronometrics In Charts’ series, Valeria Concha studies the state of the US Cherry market. Each week the series looks at a different horticultural commodity, focusing on a specific origin or topic visualizing the market factors that are driving change.

According to ODEPA (Oficina de Estudios y Políticas Agrarias de Chile) between 8 and 15 November, 10 tonnes of Cherries were shipped from Chile to the United States. These volumes, according to USDA information, were shipped by air arriving at Miami airport. It is typical for air shipments to precede the bulk of the season hoping to gain the higher prices at the beginning of the year before the industry switched to boats later on in the season. Last season air shipments of Chilean cherries accounted for 23% of the total volume.

Source: USDA Market News via Agronometrics. (Agronometrics users can view this chart with live updates here)

Source: USDA Market News via Agronometrics. (Agronometrics users can view this chart with live updates here)

The volume shipped to the United States represents only 7% of Chile's shipments since cherry exports began in October. The largest volume (88%) has been shipped to China (including Hong Kong).

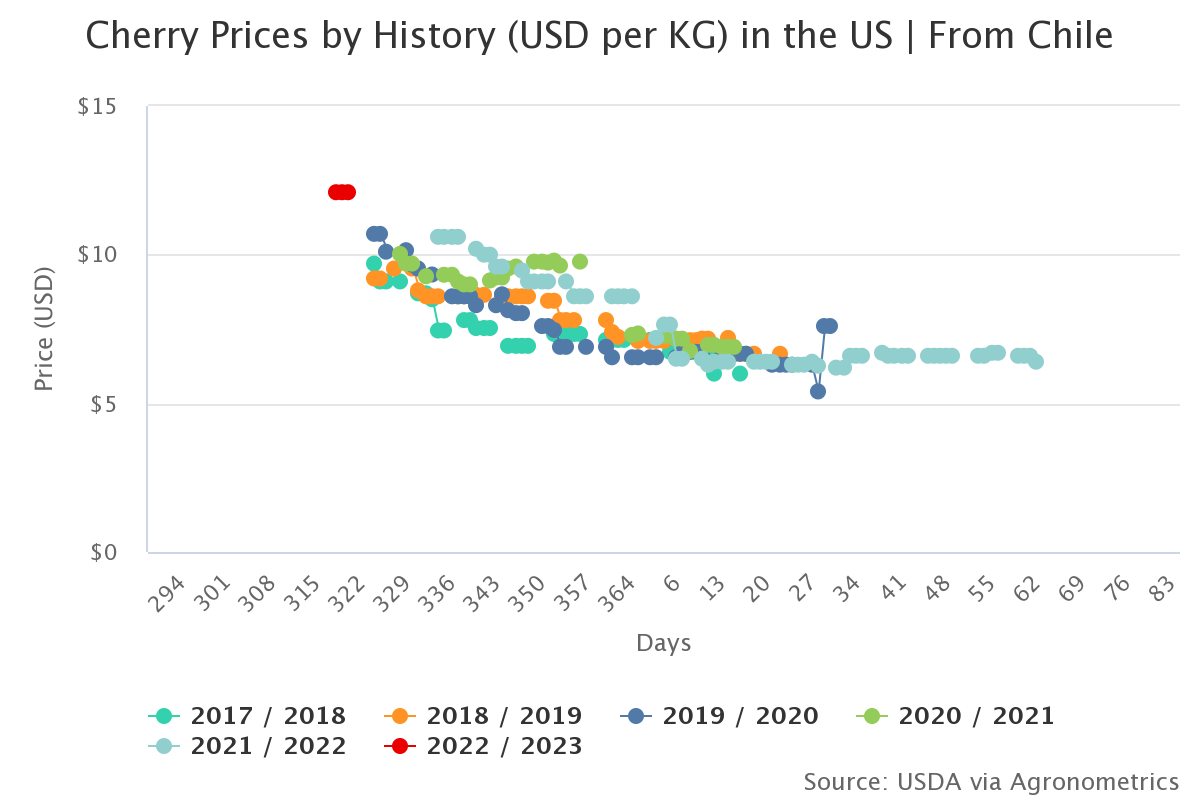

At the beginning of this week (14 November), the first prices of Chilean cherries were registered in the US market, averaging $12.10 per kilo and were recorded almost two weeks earlier in comparison to the last season. The almost zero supply of cherries in the US market allowed opening prices of almost $2 per kilo higher than those recorded at the beginning of the 2021 season. Currently, movement is expected to increase, while trading is very active.

Source: USDA Market News via Agronometrics. (Agronometrics users can view this chart with live updates here)

Source: USDA Market News via Agronometrics. (Agronometrics users can view this chart with live updates here)

During the end of week 45, rains were recorded in Chile, from Valparaiso to Los Lagos region, which damaged some crops in production, including cherries. According to Iván Marambio, president of the Chilean Fruit Exporters Association (ASOEX), and Jorge Valenzuela, president of the National Federation of Fruit Producers (Fedefruta), the damages registered so far are limited.

According to Valenzuela, preliminary estimates of damage in affected orchards do not exceed 10% of early varieties.

Regarding official data and damage estimates, both the ASOEX’s Cherry Committee and Blueberry Committee will release figures in the coming days. At the same time, Fedefruta is working on a survey for producers on crop damage.

In our ‘In Charts’ series, we work to tell some of the stories that are moving the industry. Feel free to take a look at the other articles by clicking here.

All pricing for domestic US produce represents the spot market at Shipping Point (i.e. packing house/climate controlled warehouse, etc.). For imported fruit, the pricing data represents the spot market at Port of Entry.

You can keep track of the markets daily through Agronometrics, a data visualization tool built to help the industry make sense of the huge amounts of data that professionals need to access to make informed decisions. If you found the information and the charts from this article useful, feel free to visit us at www.agronometrics.com where you can easily access these same graphs, or explore the other 21 commodities we currently track.