Agronometrics in Charts: Rising nectarine yields continue to outpace peach production in Chile

In this installment of the ‘Agronometrics In Charts’ series, Sarah Ilyas studies the state of the Chilean stone fruit season. Each week the series looks at a different horticultural commodity, focusing on a specific origin or topic visualizing the market factors that are driving change.

It is anticipated that Chilean nectarine and peach output would increase to roughly 180,000 tons in the 2022/23 season due to optimal growing conditions and higher rainfall following years of unrelenting drought. Rising nectarine output continues to outpace peach production as growers expand nectarine acreage in response to higher nectarine returns.

For MY (Marketing Year) 2022/23, Chilean fresh peach and nectarine output will total 178,500 MT, a 5.3 percent increase over MY 2021/22, according to the Stone Fruit Annual Report released by the USDA.

Owing to higher yields and growth in areas planted with nectarines, the collective exports for peaches and nectarines will climb by 5.8% to 118,000 MT. The majority of the country's nectarines are grown in central Chile, more notably in the Metropolitana and O'Higgins areas; the fruit is mostly available from December to March.

In the previous three marketing years, the area planted in both of these areas increased by 10.47 percent and 26.6 percent, respectively. Production and export of nectarines continues to be lucrative for both producers and exporters.

Additionally, it enables stone fruit producers to diversify their portfolio, lowering risk, and enabling them to maximize the use of resources available at hand by prolonging the harvest season.

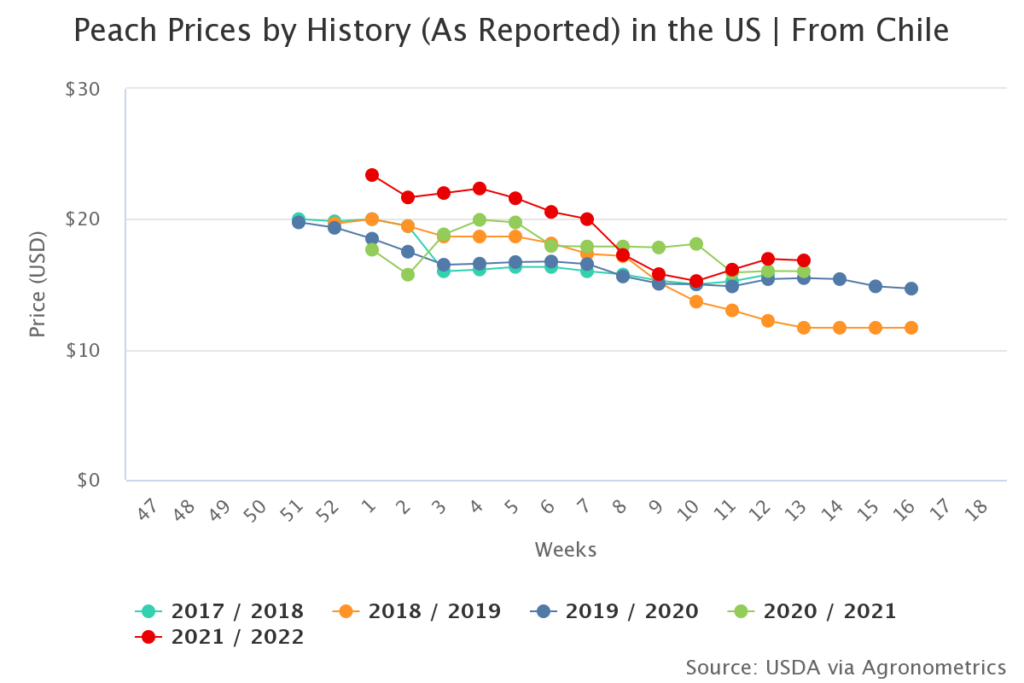

)Source: USDA Market News via Agronometrics. Agronometrics users can view this chart with live updates here)

The area planted with fresh peaches decreased by 2.2 percent from MY 2020/21 to 1,860 hectares in MY 2021/22, continuing a downward trend.

The production and export margins of fresh peach types are very low in contrast to nectarines and cherries, which is the major cause of the decrease in planted area for peaches. Owing to this, stone fruit growers have been replacing their orchards with nectarines or cherries over the previous ten marketing years. The USDA report predicts that this trend will persist in MY 2022–2023.

One of the reasons why the cultivated area for peaches has declined rapidly is that canned peach production has become less economical in comparison to other stone fruit, leading to lower gains for growers.

The tendency toward increasing nectarine cultivation will counterbalance the decrease in fresh peach production. Planted area in peaches for canning totaled 5,925 ha in MY 2021/22 a 16.7 percent decrease from MY 2020/21, according to the USDA report. Peaches are a widely exported fruit category in Chile, due to longer distances between markets, however, they must be kept chilled during transportation.

(Source: USDA Market News via Agronometrics. Agronometrics users can view this chart with live updates here)

(Source: USDA Market News via Agronometrics. Agronometrics users can view this chart with live updates here)

(Source: USDA Market News via Agronometrics. Agronometrics users can view this chart with live updates here)

According to data from Chile's national agricultural statistics office, Odepa, the nation exported 1.82 million tonnes of fresh fruit worth around US$3,899 million during the first half of 2022.

Due in part to Chile's distinctive geology and varied microclimates, stone fruits grown here are abundant and have a lengthy season.

In recent years, fruit traders in China have increasingly benefited from this long supply window and varied product portfolio, making China the most significant market in Asia for both Chilean nectarines and plums.

In our ‘In Charts’ series, we work to tell some of the stories that are moving the industry. Feel free to take a look at the other articles by clicking here.

All pricing for domestic US produce represents the spot market at Shipping Point (i.e. packing house/climate controlled warehouse, etc.). For imported fruit, the pricing data represents the spot market at Port of Entry.

You can keep track of the markets daily through Agronometrics, a data visualization tool built to help the industry make sense of the huge amounts of data that professionals need to access to make informed decisions. If you found the information and the charts from this article useful, feel free to visit us at www.agronometrics.com where you can easily access these same graphs, or explore the other 21 commodities we currently track.